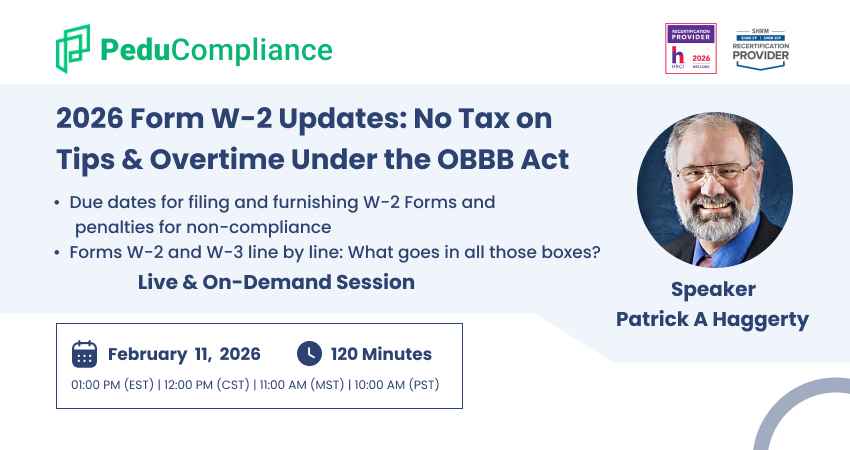

Patrick Haggerty is a tax practitioner, author, and educator. His work experience includes non-profit organization management, banking, manufacturing accounting, and tax practice. He began teaching accounting at the college level in 1988.

He is licensed as an Enrolled Agent by the U. S. Treasury to represent taxpayers at all administrative levels of the IRS and is a Certified Management Accountant. He has written numerous articles and a monthly question and answer column for payroll publications. In addition, he regularly develops and presents webinars and presentations on a variety of topics including Payroll tax issues, FLSA compliance, and information return reporting.